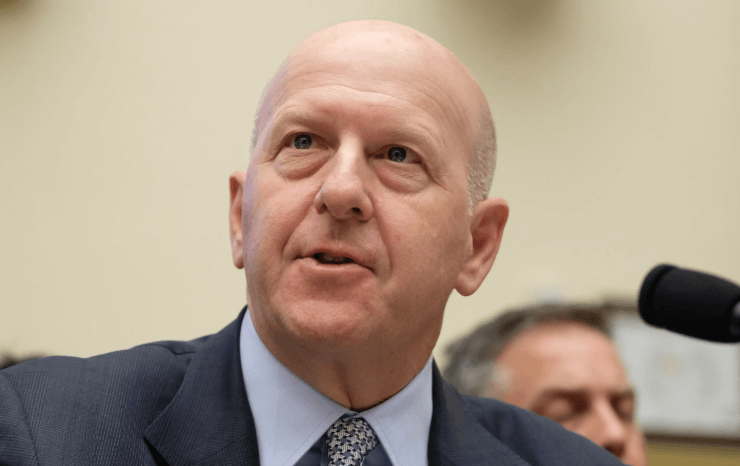

David Solomon Net Worth: CEO’s Financial Overview

David Solomon, as the CEO of Goldman Sachs, presents a compelling case study of financial success in the competitive landscape of corporate leadership. His substantial net worth is not only indicative of his hefty compensation package but also highlights the strategic investments that contribute to his financial standing. An examination of Solomon’s income sources and asset allocations reveals insights into his approach to wealth management. However, the implications of his financial strategies raise questions about sustainability and future growth, aspects that merit further exploration.

Background of David Solomon

David Solomon, the Chairman and CEO of Goldman Sachs, has a distinguished background in finance, marked by over three decades of experience in investment banking and asset management.

His career milestones include significant leadership roles within Goldman Sachs and a commitment to innovation.

Solomon balances his demanding professional life with a focus on personal life, emphasizing the importance of well-being and community engagement.

See also: Blacc Zacc Net Worth: Rapper’s Earnings and Career Success

Overview of Goldman Sachs

Goldman Sachs, founded in 1869, has evolved into one of the most prominent investment banking and financial services firms globally.

The firm offers a wide range of services, including investment banking, asset management, and securities services, catering to a diverse clientele.

Understanding Goldman Sachs’s historical context and its key financial offerings is essential to grasping its significant role in the financial industry.

History of Goldman Sachs

Founded in 1869, Goldman Sachs has evolved from a small commercial paper business into a leading global investment banking, securities, and investment management firm, reflecting significant shifts in the financial landscape over more than a century.

The firm has significantly influenced the gold market, adapting to historical trends and leveraging its expertise to navigate complex economic environments, thereby establishing a formidable presence in the industry.

Key Financial Services Offered

As a prominent player in the financial industry, Goldman Sachs offers a diverse range of services, including investment banking, asset management, and securities trading, catering to a wide array of clients from corporations to governments. Their expertise in financial advisory enhances their investment banking capabilities, ensuring tailored solutions that meet the unique needs of each client.

| Service Type | Description |

|---|---|

| Investment Banking | Mergers, acquisitions, and capital raising. |

| Asset Management | Portfolio management and investment strategies. |

| Securities Trading | Execution of trades across various markets. |

David Solomon’s Compensation Package

David Solomon’s compensation package, which includes a combination of base salary, bonuses, and stock options, reflects his pivotal role as CEO of Goldman Sachs and aligns with industry standards for executives in the financial sector.

This compensation structure is designed to incentivize performance, with substantial executive bonuses tied to company profitability, ensuring that Solomon’s interests align with those of shareholders and stakeholders alike.

Sources of Income

What are the primary sources of income that contribute to David Solomon’s net worth?

Solomon’s financial portfolio is bolstered by significant earnings from his role as CEO, complemented by lucrative stock options.

Additionally, investments in real estate provide a stable revenue stream.

These diverse income sources reflect a strategic approach to wealth accumulation, enabling him to leverage opportunities in both corporate and personal assets.

Investments and Assets

The diverse income sources mentioned previously are complemented by a well-curated portfolio of investments and assets that further enhance Solomon’s financial standing. His strategic investments in real estate and a robust stock portfolio showcase a keen understanding of market dynamics, allowing him to navigate economic fluctuations effectively.

| Asset Type | Estimated Value | Location/Focus |

|---|---|---|

| Real Estate | $XX Million | Urban and suburban areas |

| Stock Portfolio | $XX Million | Tech and finance sectors |

| Alternative Investments | $XX Million | Startups and venture capital |

| Cash Reserves | $XX Million | Liquid assets |

Comparison With Industry Peers

In assessing David Solomon’s net worth, it is essential to compare his earnings with those of his industry competitors.

This analysis not only highlights his financial standing but also positions him within the broader context of CEO wealth rankings.

Understanding these dynamics provides valuable insight into Solomon’s influence and status in the financial sector.

Solomon’s Earnings Vs. Competitors

David Solomon’s earnings are often contrasted with those of his peers in the investment banking sector, highlighting the competitive landscape of executive compensation within the industry.

A Solomon earnings comparison reveals that his total compensation frequently aligns with or exceeds that of major competitors.

This competitor salary analysis underscores the importance of performance-driven pay structures, reflecting market dynamics and the demand for top leadership talent.

Wealth Ranking Among CEOs

Wealth rankings among CEOs reveal that David Solomon positions himself favorably within the competitive landscape, often appearing among the top earners in the financial services sector. His CEO wealth is a reflection of his leadership at Goldman Sachs, where he consistently ranks alongside industry peers. Below is a comparison of notable CEO wealth.

| CEO | Company | Wealth Ranking |

|---|---|---|

| David Solomon | Goldman Sachs | 3rd |

| Jamie Dimon | JPMorgan Chase | 1st |

| Brian Moynihan | Bank of America | 2nd |

Future Financial Outlook

The future financial outlook for David Solomon appears promising, driven by strategic initiatives and the resilience of the investment banking sector.

Investment trends indicate a shift towards technology-driven solutions, while market predictions suggest potential growth in emerging markets.

Solomon’s leadership is likely to capitalize on these developments, positioning him and Goldman Sachs favorably amid evolving economic landscapes and increasing client demands.

Conclusion

In conclusion, David Solomon’s financial landscape exemplifies the rewarding nature of leadership within the competitive finance sector.

The intricacies of his compensation package and diverse investment portfolio reveal a calculated approach to wealth accumulation.

By strategically navigating opportunities in both traditional finance and emerging technology, Solomon positions himself favorably among contemporaries.

As market dynamics evolve, the potential for further financial growth remains promising, underscoring the resilience and adaptability of seasoned executives in today’s economic climate.